All Categories

Featured

Table of Contents

The are entire life insurance coverage and global life insurance policy. grows money value at an assured passion price and also through non-guaranteed rewards. expands money value at a taken care of or variable price, depending on the insurance provider and plan terms. The money value is not included in the survivor benefit. Cash worth is a function you take benefit of while active.

The policy finance interest price is 6%. Going this route, the rate of interest he pays goes back right into his plan's money value instead of a monetary establishment.

Think of never having to fret about small business loan or high rate of interest once again. Suppose you could obtain money on your terms and construct riches concurrently? That's the power of limitless financial life insurance policy. By leveraging the money value of entire life insurance policy IUL policies, you can grow your riches and obtain money without depending on traditional banks.

There's no collection funding term, and you have the liberty to pick the repayment timetable, which can be as leisurely as settling the financing at the time of death. This versatility reaches the servicing of the financings, where you can choose for interest-only settlements, maintaining the loan balance flat and manageable.

Holding cash in an IUL repaired account being credited interest can often be better than holding the cash money on deposit at a bank.: You've always dreamed of opening your very own bakeshop. You can obtain from your IUL policy to cover the initial costs of leasing a space, purchasing devices, and hiring team.

Infinite Bank

Personal fundings can be gotten from conventional financial institutions and lending institution. Below are some bottom lines to take into consideration. Bank card can supply a flexible means to obtain money for very temporary periods. However, obtaining money on a bank card is normally extremely costly with interest rate of rate of interest (APR) usually reaching 20% to 30% or more a year.

The tax treatment of policy loans can vary considerably relying on your country of residence and the particular terms of your IUL policy. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy car loans are normally tax-free, using a considerable advantage. Nevertheless, in various other territories, there might be tax obligation effects to think about, such as potential taxes on the loan.

Term life insurance coverage only gives a fatality advantage, without any type of cash worth buildup. This suggests there's no cash worth to borrow against.

Infinite Banking With Whole Life Insurance

When you first listen to about the Infinite Financial Idea (IBC), your initial response could be: This seems as well good to be true. Probably you're skeptical and think Infinite Financial is a rip-off or system - royal bank infinite avion travel insurance. We desire to establish the record straight! The problem with the Infinite Financial Idea is not the idea however those individuals supplying an unfavorable critique of Infinite Banking as a concept.

As IBC Authorized Practitioners via the Nelson Nash Institute, we believed we would respond to some of the top inquiries people search for online when learning and understanding whatever to do with the Infinite Banking Idea. What is Infinite Banking? Infinite Banking was developed by Nelson Nash in 2000 and completely described with the magazine of his book Becoming Your Own Lender: Unlock the Infinite Financial Principle.

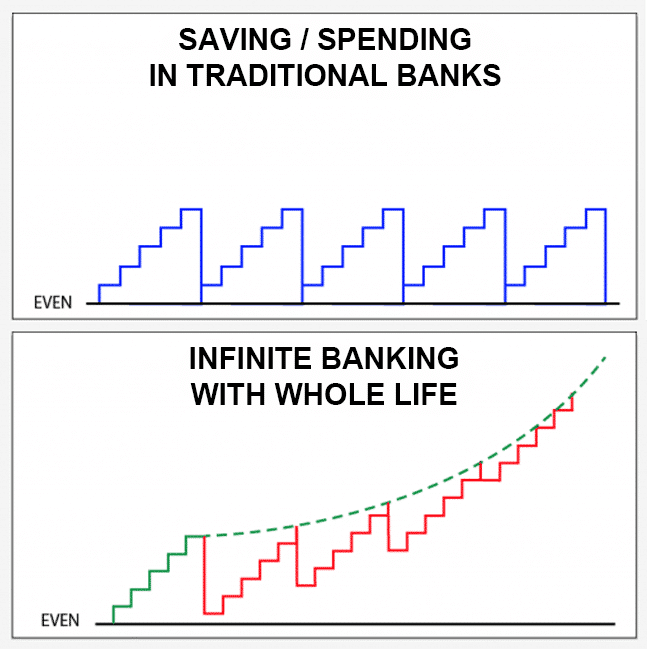

Becoming Your Own Banker Nash

You assume you are coming out economically ahead because you pay no passion, however you are not. When you save cash for something, it typically indicates giving up something else and reducing on your lifestyle in other locations. You can duplicate this process, however you are simply "reducing your way to wealth." Are you happy living with such a reductionist or deficiency attitude? With saving and paying money, you might not pay passion, yet you are using your cash when; when you invest it, it's gone forever, and you surrender on the opportunity to earn lifetime substance passion on that money.

Even financial institutions utilize whole life insurance coverage for the very same purposes. The Canada Revenue Agency (CRA) even identifies the value of taking part entire life insurance coverage as a distinct asset course used to produce long-term equity securely and predictably and give tax benefits outside the scope of typical financial investments.

Royal Bank Avion Infinite

It permits you to create wide range by meeting the financial feature in your very own life and the capability to self-finance major lifestyle acquisitions and costs without interrupting the substance passion. One of the most convenient ways to think of an IBC-type taking part entire life insurance policy policy is it approaches paying a home mortgage on a home.

In time, this would certainly develop a "continuous compounding" effect. You get the image! When you borrow from your getting involved whole life insurance policy, the money value proceeds to grow undisturbed as if you never ever obtained from it to begin with. This is since you are utilizing the cash worth and death benefit as collateral for a loan from the life insurance policy business or as security from a third-party loan provider (called collateral lending).

That's why it's vital to collaborate with a Licensed Life insurance policy Broker accredited in Infinite Financial who structures your taking part whole life insurance policy plan appropriately so you can prevent adverse tax obligation ramifications. Infinite Financial as a financial approach is except every person. Here are several of the benefits and drawbacks of Infinite Banking you need to seriously think about in making a decision whether to progress.

Our favored insurance provider, Equitable Life of Canada, a common life insurance policy company, focuses on participating entire life insurance coverage plans certain to Infinite Banking. In a mutual life insurance business, insurance policy holders are taken into consideration firm co-owners and receive a share of the divisible surplus generated yearly through rewards. We have a range of carriers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the requirements of our clients.

Please also download our 5 Leading Concerns to Ask An Infinite Banking Representative Prior To You Hire Them. To find out more regarding Infinite Banking go to: Please note: The material supplied in this e-newsletter is for educational and/or instructional purposes just. The details, point of views and/or sights shared in this e-newsletter are those of the authors and not necessarily those of the representative.

Infinite Banking Think Tank

Nash was a finance expert and fan of the Austrian college of business economics, which supports that the worth of products aren't clearly the outcome of traditional financial structures like supply and demand. Rather, people value money and goods differently based on their economic standing and needs.

One of the mistakes of conventional banking, according to Nash, was high-interest prices on financings. A lot of people, himself consisted of, got into economic difficulty because of dependence on banking organizations. So long as banks established the rates of interest and lending terms, people really did not have control over their very own wealth. Becoming your own lender, Nash identified, would certainly place you in control over your monetary future.

Infinite Banking needs you to possess your monetary future. For ambitious individuals, it can be the very best financial device ever before. Here are the advantages of Infinite Banking: Probably the solitary most advantageous aspect of Infinite Banking is that it enhances your capital. You don't need to undergo the hoops of a standard bank to obtain a finance; just request a plan car loan from your life insurance policy company and funds will certainly be offered to you.

Dividend-paying entire life insurance coverage is really reduced danger and supplies you, the insurance policy holder, a fantastic bargain of control. The control that Infinite Banking provides can best be grouped into 2 categories: tax benefits and property securities.

Entire life insurance coverage policies are non-correlated possessions. This is why they work so well as the financial structure of Infinite Banking. Regardless of what takes place in the market (stock, genuine estate, or otherwise), your insurance coverage policy preserves its well worth.

Whole life insurance policy is that third container. Not only is the rate of return on your entire life insurance coverage policy assured, your fatality benefit and premiums are likewise guaranteed.

What Is Infinite Banking Life Insurance

This structure lines up perfectly with the concepts of the Perpetual Wide Range Technique. Infinite Banking interest those looking for greater monetary control. Right here are its major benefits: Liquidity and ease of access: Policy financings give instant access to funds without the limitations of typical bank car loans. Tax obligation performance: The cash money worth grows tax-deferred, and plan car loans are tax-free, making it a tax-efficient device for constructing riches.

Possession defense: In lots of states, the cash money value of life insurance policy is safeguarded from financial institutions, adding an additional layer of monetary safety and security. While Infinite Banking has its advantages, it isn't a one-size-fits-all remedy, and it features substantial drawbacks. Below's why it might not be the very best strategy: Infinite Banking commonly needs intricate policy structuring, which can perplex policyholders.

Table of Contents

Latest Posts

Be Your Own Banker Nash

Be Your Own Bank - Infinite Growth Plan

Banking Life

More

Latest Posts

Be Your Own Banker Nash

Be Your Own Bank - Infinite Growth Plan

Banking Life